|

| CRYPTOCURRENCY |

Cryptocurrency

A cryptocurrency or crypto is a virtual currency secured by cryptography. It is designed to work as a medium of exchange, where individual ownership records are stored in a computerized database.

- Address: Cryptocurrency coins are identified on the blockchain by unique addresses. You can think about the blockchain as a GPS and your cryptocurrency address as its targeted mailing address. Without an address, no coin is stored; the blockchain can’t confirm nor verify its existence. So, without a proper wallet address, you can’t own a coin.

- Altcoin: Altcoin means all cryptocurrencies that aren’t Bitcoin (and in some contexts, Ether). The phrase is used matter-of-factly to describe various other cryptocurrencies.

- Ethereum is currently the world’s largest altcoin.

- Bitcoin Maximalist: Bitcoin Maximalist refers to a person who believes that Bitcoin is the only cryptocurrency of value.

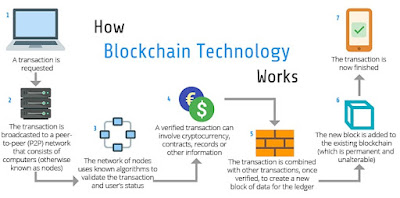

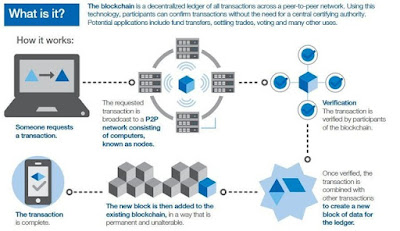

- Blockchain: Blockchain, which consists of a series of blocks, is a digital ledger of all the verified transactions made on a particular cryptocurrency.

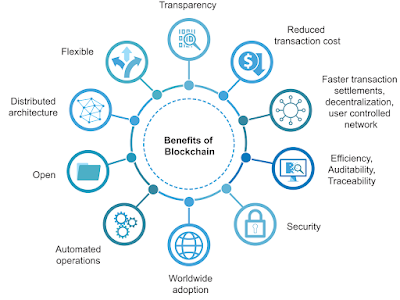

Benefits of Blockchain

Blockchain Technology - Blocks: Blocks make up a blockchain, and each block carries a historical database of all the transactions conducted on crypto until it becomes full.

- BTFD: BTFD is an acronym for “Buy The F**king Dip.” This is used when a trader tells others to pick up a digital currency that has dropped in value.

- dApps: dApp is short for “decentralized app,” meaning any practical application of blockchain and/or cryptocurrency. dApps can take the form of mobile games, communications platforms, and social media sites.

- DeFi: DeFi is short for Decentralized Finance. DeFi is the movement within crypto to not just trade decentralized currencies but do so in a way that is itself decentralized. The most popular DeFi projects are decentralized exchange protocols, which automate the exchange of cryptocurrencies among buyers and sellers, eliminating the need for a middleman.

- Digital Currency: Digital currency… so like cryptocurrency, right? Not exactly.

- A digital currency can be linked to fiat currency too. In fact, most major nations have a digital currency tied to their fiat right now, including the US and China. A digital currency depends on trust—you rely on multiple institutions to carry out a transaction. Crypto, on the other hand, is trustless, you can verify transactions and records of the address you are transacting with in real-time.

- In other words, you can’t see the transaction history of your counterparty and third party payment processor when you go to sell a pair of shoes on StockX. You trust Paypal (and your bank) to safely and securely carry out that transaction.

- Distributed Ledger Technology (DLT): We touched on the concept behind public ledgers—that place you go to view all transactions made on a blockchain. DLT refers to a distributed ledger, another term for blockchain technology. When you see DLT, think blockchain. Take note of that.

- Fiat: Fiat is a term for government issued currencies, like the U.S. dollar or Japanese yen. In a broader sense, fiat is used to describe any currency controlled by a central authority. Bitcoin, in its decentralized design, serves as a counterpoint to traditional fiat currencies.

- Fork: A fork is when a cryptocurrency or blockchain-based network splits off into two distinct projects with their own code and set of governing principles. In the event of a “soft” fork, only one blockchain will remain operational, whereas “hard” forks result in two new brand chains. For example, Bitcoin Classic is a hard fork of Bitcoin, since both cryptocurrencies run on standalone blockchains, with their own sets of miners, nodes and network participants.

- Gas: When you make a transaction on the blockchain, you have to pay a fee. That fee is called a gas price. You are basically paying a miner to go out and receive crypto for you. You can choose to pay higher fees for faster transaction speeds, or lower fees for slower transaction fees.

- Halving: It refers to one of the most anticipated events for Bitcoin. It is a process of halving the rewards of mining Bitcoin after around 210,000 blocks are mined. This usually takes around four years. Halving is to make sure that the number of Bitcoin in circulation does not increase exponentially.

- Hash Rate: Hash rate is the measure of computing and processing power used in crypto mining, the process of obtaining a cryptocurrency through powerful computers and specially designed software. A higher hash rate indicates a more robust network.

- Hodl: Hodl is not a misspelling; it is slang. According to Internet legend, an early enthusiast’s finger slipped, and he typed “Hodl” on an Internet chat forum, urging his fellow investors to not sell. Today, when Bitcoin tumbles, loyal investors urge each other to “Hodl” and not sell their tokens. The idea behind Hodl is that Bitcoin’s price will continue to rise, regardless of huge dips. The phrase signals loyalty and belief in Bitcoin’s ascent.

- ICO: An ICO, or Initial Coin Offering, is how blockchain projects raise money and launch their virtual currency networks. ICOs exploded in popularity in 2017 and 2018 amid the broader market frenzy. Many ICOS were classic pump-and-dump schemes; the Securities and Exchange Commission has sued many of them.

- Mining: Mining is the process through which new cryptocurrencies are minted. Many cryptocurrencies depend on a proof-of-work mining system, whereby computational power is delegated towards solving complex math riddles as a way to simultaneously secure and power a network, while also minting new tokens.

Cryptocurrency Mining - NFT: An NFT, or Nonfungible Token, is a digital asset that confers ownership of a virtual good, such as a piece of digital artwork or online collectible. Most cryptocurrencies are “fungible”, meaning there is no meaningful distinction between one coin and another.

- Pump and Dump: Pump and Dump is a form of price manipulation where the price of a crypto is boosted based on false recommendations (pump) before the assets are sold at a higher price (dump).

- Proof of Authority (PoA): In a blockchain operated under Proof of Authority (PoA), a few specific nodes are granted the right (or authority) to approve a miner’s ability to create a block. This is a faster alternative to the proof-of-work model, but more centralized.

- Proof of Work (PoW): Proof of Work is a more traditional method to award miners for their effort. It requires miners to show their effort by tying a variable to the process of hashing a transaction. A hashed block proves work was completed and awards the miner. This takes up a lot of energy.

- Proof of Stake (PoS): Proof of Stake allows a person to validate or mine cryptocurrency based on the number of coins he or she owns. Under this model, the idea is that a miner will be less likely to attack a network if they have a stake in the game.

- Public Key: A public key is a string of characters used to purchase cryptocurrency. If a content creator, for example, wants to receive cryptocurrency instead of fiat for his or her content, they can list their public key. Fans can easily send cryptocurrency using the content creator’s public key.

- Public Ledger: Each blockchain has its own ledger. This is the place where you can view every transaction ever made on a blockchain, given that it’s public. Some coins distinguish themselves by operating on an anonymous or private ledger.

- Satoshi: Satoshi means one of two things. The first is in reference to Satoshi Nakomoto, the anonymous founder of Bitcoin who vanished shortly after his creation, leaving the project to be decentralized and collectively managed. Satoshi also means a unit of exchange, equal to .0001 Bitcoins. The term is often used casually in the context of Stacking Sats, i.e. buying more Bitcoin.

Satoshi Nakomoto - Stablecoin: A stablecoin is any cryptocurrency or blockchain-based token whose value is pegged to another source of value – typically a fiat currency. For instance, one dollar-pegged stablecoin is equivalent to $1. Stablecoins are commonly used to facilitate cryptocurrency trading and cross-border finance.

- SEED: The seed is the foundation of your wallet’s digital existence. A recovery seed is a series of twelve, sometimes sixteen words that can be used to access your wallet if something goes wrong and you lose it.

- Segregated Witness (SEGWIT): Another tech term, SEGWIT refers to the process that separates digital signature data from transaction data. This allows more transactions to fit on one block, increasing the speed of transactions. Put simply, it’s a good value-add for blockchains.

- Smart Contracts: A core feature of the Ethereum blockchain and NFTs, smart contracts are just your typical boring legal contracts… only they're written in computer code.Smart contracts hold multiple parties accountable for something, just like a normal legal contract, but it instructs each party through code rather than spoken language. Both parties can see and approve of the programming before accepting a contract’s terms, making it completely transparent.

- Token: A token refers to a unit of a digital currency like Bitcoin.

- To the Moon: If someone says To the Moon or posts a rocket emoji, it means they think the price of a cryptocurrency is going to see a huge increase.

- Rekt: Rekt is a crypto slang for "wrecked." This is used when a trader loses a substantial amount of money.

- Wallet: A cryptocurrency wallet is similar in function to a physical wallet: it’s a place to store tokens. But not all crypto wallets are made equal. “Hot” wallets are online, meaning crypto tokens are easily accessible but also more susceptible to hackers. “Cold” wallets store digital assets off-line, making them secure from bad actors but difficult to trade.

- Whale: Whales are individual investors and often sophisticated trading firms with large amounts of Bitcoin and other cryptocurrency. Whales are feared and respected among crypto day traders for their ability to move prices with single trades. Whales include the prescient individuals who bought Bitcoin in its early years and never sold.

Rules for Cryptocurrency in India:-

Comments